Orthopedic ASCs: 2024 Growth and Challenges

It’s a new year, and orthopedic ambulatory surgery centers (ASCs) look poised to continue their explosive growth and expansion over the next few years. According to one analysis, the U.S. orthopedic ASC market size is expected to reach $15 billion by 2030, expanding at a compound annual growth rate of 4.6% from 2025-2030. This projected growth builds on the rapid expansion of orthopedic ASCs over the past decade. Since 2010, the number of orthopedic procedures performed in ASCs has increased by over 50%, far outpacing the growth in hospital outpatient departments.

Orthopedic ASCs have experienced tremendous growth due to their ability to provide patients with greater convenience, shorter wait times, and lower costs compared to hospital settings. Their value proposition of high-quality orthopedic care in an efficient outpatient environment has appealed to patients, surgeons, and payers alike. This has allowed orthopedic ASCs to capture increasing market share for common orthopedic procedures like knee and hip replacements, spine surgery, and sports medicine repairs that were traditionally performed in hospitals.

As we look towards 2024, orthopedic ASCs appear well-positioned for continued expansion but will also face new challenges that require strategic adaptation. This analysis will provide an overview of the outlook based on recent industry research, highlighting key issues orthopedic ASCs must navigate to sustain growth and profitability in the coming years.

Addressing the Looming Physician Shortage

The orthopedic specialty is facing a significant shortage of surgeons in the coming years. According to projections from the Health Resources and Services Administration (HRSA), there will be a shortage of 5,080 orthopedic surgeons in the US by 2025. This looming shortage impacts all orthopedic subspecialties and threatens patient access to timely orthopedic care.

The orthopedic specialty is facing a significant shortage of surgeons in the coming years. According to projections from the Health Resources and Services Administration (HRSA), there will be a shortage of 5,080 orthopedic surgeons in the US by 2025. This looming shortage impacts all orthopedic subspecialties and threatens patient access to timely orthopedic care.

Innovative recruitment and retention strategies will be critical for orthopedic ASCs to attract and keep top surgical talent amidst growing competition. Offering comprehensive benefits packages, schedule flexibility, profit-sharing incentives, and training opportunities are key areas to focus on. Streamlining administrative burdens through advanced practice providers and other support staff can also make positions at orthopedic ASCs more appealing to surgeons.

Equipping surgeons with cutting-edge technologies like robotics and navigation systems can maximize their productivity and efficiency. By optimizing surgeon time and minimizing repetitive manual tasks via automation, ASCs can enable their physicians to take on more procedures and patients. Investing in these types of innovations will be vital for orthopedic centers to thrive with fewer surgeons while maintaining high-quality care and outcomes.

Adapting to Regulatory Changes

One of the biggest challenges facing orthopedic ASCs in 2024 will be adapting to upcoming changes in CMS regulations. In the CY 2024 Hospital Outpatient Prospective Payment System (OPPS) final rule, CMS finalized several policies that will impact reimbursement and coverage for orthopedic procedures in the ASC setting.

One of the biggest challenges facing orthopedic ASCs in 2024 will be adapting to upcoming changes in CMS regulations. In the CY 2024 Hospital Outpatient Prospective Payment System (OPPS) final rule, CMS finalized several policies that will impact reimbursement and coverage for orthopedic procedures in the ASC setting.

A major change is CMS reducing payment for procedures involving implantable devices performed in ASCs. CMS cited the need to align ASC payment rates for device-intensive procedures with hospital outpatient rates, which are lower. This change will reduce payments for many common orthopedic procedures involving implants, negatively impacting profit margins.

Additionally, CMS is eliminating the Inpatient Only (IPO) list over the next few years, with 275 procedures removed for 2024. This expands the number of musculoskeletal procedures payable in ASCs but also increases competition from hospitals. To adapt, ASCs should focus on their advantages in efficiency, convenience and patient experience.

Orthopedic ASCs will need strategies to maintain strong financial performance amid these changes. Expanding clinical capabilities to keep pace with procedures moving off the IPO list can open up new revenue streams. Detailed cost analysis and negotiations with implant vendors will also be crucial to preserving margins on device-heavy procedures. Ultimately, orthopedic ASCs must make the most of their strengths in patient-centered care and surgical quality to succeed in the new regulatory climate.

Harnessing Data and Analytics

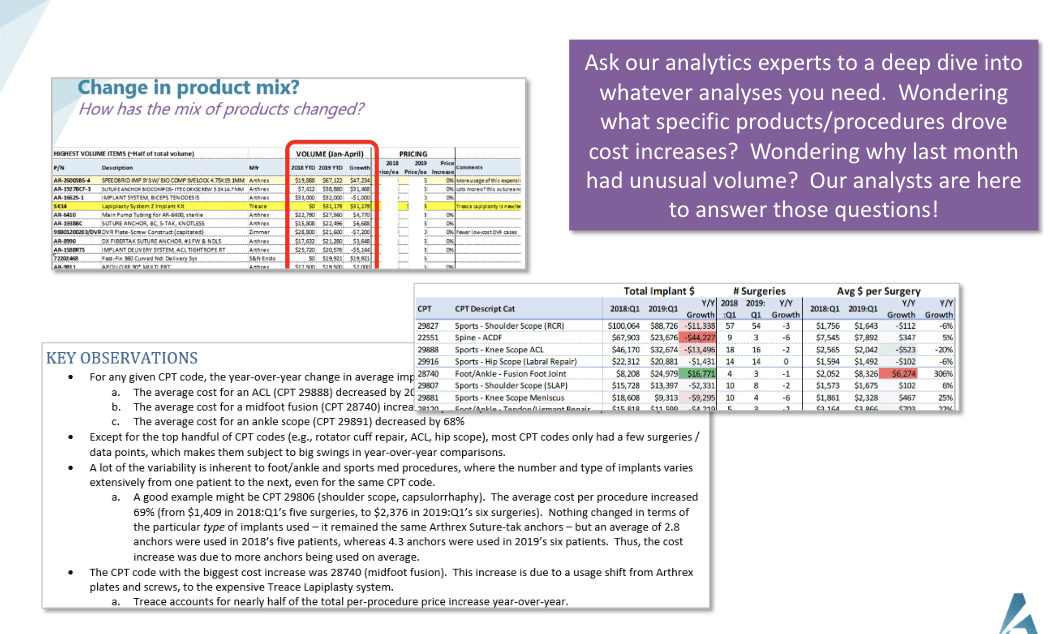

With healthcare reform on the horizon and increasing competition, it will be more important than ever for orthopedic ASCs to harness data and analytics for asc facility optimization. According to a recent report by SmartTRAK, precision analytics will be crucial for driving clinical and financial performance in ASCs.

With healthcare reform on the horizon and increasing competition, it will be more important than ever for orthopedic ASCs to harness data and analytics for asc facility optimization. According to a recent report by SmartTRAK, precision analytics will be crucial for driving clinical and financial performance in ASCs.

Specifically, SmartTRAK notes that “by combining clinical data with financial data in one analytics platform, ASCs can pinpoint opportunities to improve quality outcomes, minimize complications and readmissions, and reduce supply costs.”[1] Using benchmarking and dashboard reporting, ASCs can continuously monitor KPIs against internal goals and external benchmarks.

In addition, artificial intelligence and machine learning have exciting potential applications in ASCs. As one example, machine learning algorithms can analyze past surgical cases to predict the likelihood of patients developing complications based on their health profile and procedure variables. This allows for targeted preventative interventions.

While AI adoption is still in early stages, forward-thinking ASCs should pilot these technologies to get a head start on harnessing their benefits. With the right data infrastructure and analytics strategy, orthopedic ASCs can gain actionable insights to optimize nearly all aspects of care delivery and financial operations.

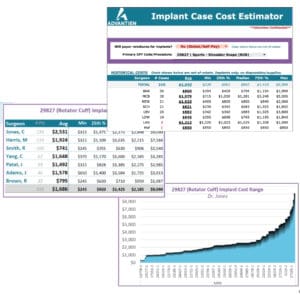

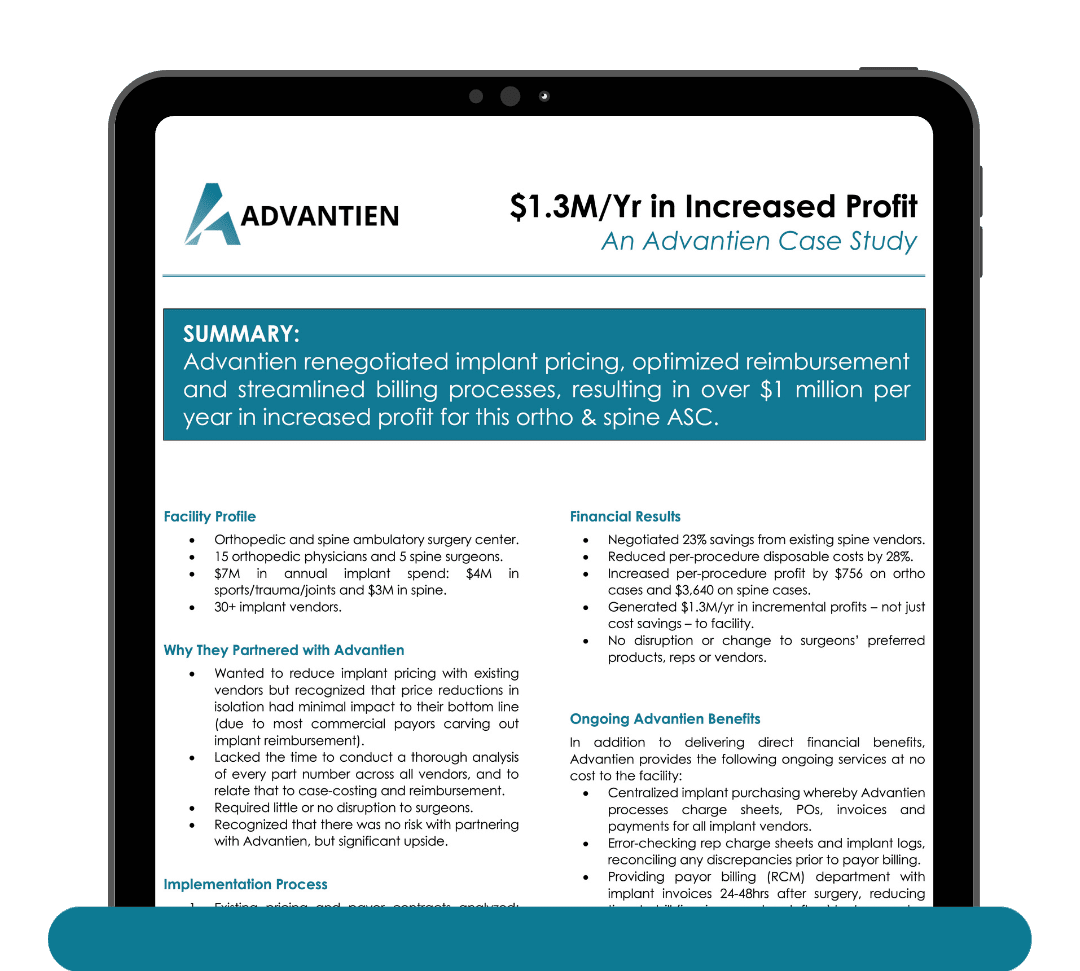

Another strategy for leveraging data analysis is partnering with a third-party implant revenue management company like Advantien. With over a decade of experience and data from analyzing hundreds of thousands of implant spends, they’re experts at optimizing orthopedic ASC’s savings and profit opportunities. By utilizing a proprietary benchmarking process, they can analyze your implant usage and spending, case mix, payor mix, and expected reimbursements and then optimize to improve your profits so you’re not relying on guesswork.

Investing in Innovation

Orthopedic ASCs have an opportunity to invest in cutting-edge innovations that can enhance surgical precision and improve patient outcomes. Advances in minimally invasive techniques are allowing procedures to be performed through smaller incisions, resulting in less pain, quicker recovery, and reduced scarring for patients. The adoption of robotics and computer navigation technology shows tremendous promise as well. Systems like Mako Robotic-Arm Assisted Surgery allow surgeons to pre-plan procedures and receive real-time feedback during surgery for greater accuracy and consistency.

Orthopedic ASCs have an opportunity to invest in cutting-edge innovations that can enhance surgical precision and improve patient outcomes. Advances in minimally invasive techniques are allowing procedures to be performed through smaller incisions, resulting in less pain, quicker recovery, and reduced scarring for patients. The adoption of robotics and computer navigation technology shows tremendous promise as well. Systems like Mako Robotic-Arm Assisted Surgery allow surgeons to pre-plan procedures and receive real-time feedback during surgery for greater accuracy and consistency.

Additionally, the use of 3D printing for customized joint replacements tailored to a patient’s unique anatomy has exciting potential. Rather than mass-produced implants, personalized 3D-printed implants can provide better fit, function, and longevity.

By embracing such innovations in surgical tools, techniques, and implants, orthopedic ASCs can attract the best surgeons who want access to the latest technology. This enables ASCs to market themselves as elite centers of excellence, providing patients with cutting-edge orthopedic care.

Specializing for Growth

As the healthcare landscape continues to evolve, orthopedic ASCs have a major opportunity to capture market share by developing specialized centers of excellence focused on high-demand services like joint replacements and spine surgery. According to the American Academy of Orthopaedic Surgeons (AAOS), over half of all ASC procedures performed in 2020 were in orthopedics, demonstrating the growth in demand for these services. By concentrating expertise, technology and resources into specific service lines, ASCs can provide exceptional care and outcomes that rival major hospitals and academic medical centers.

As the healthcare landscape continues to evolve, orthopedic ASCs have a major opportunity to capture market share by developing specialized centers of excellence focused on high-demand services like joint replacements and spine surgery. According to the American Academy of Orthopaedic Surgeons (AAOS), over half of all ASC procedures performed in 2020 were in orthopedics, demonstrating the growth in demand for these services. By concentrating expertise, technology and resources into specific service lines, ASCs can provide exceptional care and outcomes that rival major hospitals and academic medical centers.

Joint replacement represents an especially lucrative area for specialization, given the aging population and rise of degenerative conditions like osteoarthritis. McKinsey predicts a 174% increase in demand for total hip and knee replacements from 2005 to 2030. Spine surgery is another prime target, with minimally invasive techniques allowing a greater number of procedures to be performed in the outpatient setting. To expand service offerings, ASCs must strategically recruit experts, invest in cutting-edge equipment and earn key accreditations like AAAHC.

By developing renowned programs known for outstanding clinical outcomes and patient experiences, orthopedic ASCs can establish themselves as the preferred destination for joint replacement, spine surgery, and other high-demand procedures in their regional marketplace.

Delivering Outstanding Patient Experiences

Orthopedic ASCs will need to focus on delivering exceptional patient experiences in 2024 to drive loyalty and positive word-of-mouth referrals. According to research, patients who are highly satisfied with their surgical experience are more likely to attend follow-up appointments and recommend the facility to others (Howard, 2020).

Orthopedic ASCs will need to focus on delivering exceptional patient experiences in 2024 to drive loyalty and positive word-of-mouth referrals. According to research, patients who are highly satisfied with their surgical experience are more likely to attend follow-up appointments and recommend the facility to others (Howard, 2020).

To raise the bar on patient-centered care, ASCs should invest in comfort amenities, communicate clearly at every stage, and ensure smooth discharge and follow-up. Small touches like comfortable lobbies, snacks, and entertainment during long waits can enhance satisfaction.

Convenience and cutting-edge facilities also drive loyalty. Locating near patient populations and offering extended hours removes access barriers. Modern equipment and technologies like robotics demonstrate an ASC’s commitment to state-of-the-art care.

Ultimately, positive word-of-mouth from delighted patients provides invaluable marketing. ASCs delivering outstanding experiences will be rewarded as satisfied patients tell family, friends, and online communities about their exemplary care. This organic advocacy is key to long-term growth and sustainability (Orthopedic Ambulatory Surgery Center Trends, 2023).

Focusing on Cost Containment

Orthopedic surgery is among the most expensive medical specialties, and the pressure to lower costs is likely to intensify in 2024 and beyond. According to Chen et al., minor changes to minimize costs within orthopedics could result in substantial savings given it is the most frequently used surgical subspecialty. However, few cost-minimization initiatives have been described in the literature.

Orthopedic surgery is among the most expensive medical specialties, and the pressure to lower costs is likely to intensify in 2024 and beyond. According to Chen et al., minor changes to minimize costs within orthopedics could result in substantial savings given it is the most frequently used surgical subspecialty. However, few cost-minimization initiatives have been described in the literature.

Orthopedic ASCs will need to get creative with initiatives to increase efficiency and streamline care delivery while still delivering excellent outcomes. This could involve standardizing implant usage, optimizing OR staffing models, leveraging technology for pre-op assessments, and sterilizing/reprocessing single-use devices when clinically appropriate (AJMC, 2020).

Partnerships with orthopedic implant billing companies such as Advantien will also be key for driving down the cost of devices and supplies. By leveraging their extensive experience for data-driven implant price negotiations with vendors, case costing tools to maximize surgery case cost efficiency, and surgeon scorecards to establish best practices and physician engagement are key for keeping cost savings and improved profits.

What to Expect in 2024 for Orthopedic ASCs

Orthopedic ASCs have a bright future ahead in 2024 and beyond if they take proactive steps to address looming challenges while capitalizing on emerging opportunities. To overcome the physician shortage, ASCs will need to tap into innovative recruitment and retention strategies, like remote work flexibility and profit-sharing agreements.

Adapting to changing CMS regulations will require diligent compliance efforts and adjusting care protocols and pricing to maintain strong profit margins. Optimizing their use of data and analytics will allow ASCs to hone their business operations, clinical outcomes, and patient experiences to new levels. Investing in advanced minimally invasive techniques, robotics, navigation systems, and 3D printing will enable ASCs to provide cutting-edge personalized care and attract more patients.

Developing specialized centers of excellence in high-demand areas like joint replacements and spine surgery is another avenue for growth and market differentiation. Delivering outstanding patient-centered experiences focused on convenience, amenities, and customer service will lead to increased loyalty and positive word-of-mouth referrals.

Finally, leveraging the expertise of implant revenue management companies specializing in ASC profitability ensures competitive pricing for orthopedic implants and a fully optimized supply chain. ASCs able to enact these forward-thinking strategies will emerge as leaders and experience sustainable success in 2024 and beyond.

While regulatory and economic headwinds are on the horizon, the outlook for progressive orthopedic ASCs focused on innovation remains bright. By embracing new technologies, adopting advanced analytics, providing specialized services, and putting patients first, orthopedic ASCs can continue thriving as top destinations for accessible, affordable, and quality musculoskeletal care.

One thought on “Orthopedic ASCs: 2024 Growth and Challenges”

Comments are closed.